author: Captain Ray Roberts

updated: 7-20-2022

Powerboat and sailboat insurance comparison: our 2022 review.

Here we explain the basics of marine insurance and review the best boat insurance providers.

Hopefully his policy hasn’t expired…

Finding the best boat insurance package shouldn’t be a difficult job. You need to review insurance policies from at least 3 reputable providers, then pick the most appropriate one. Give them your credit card number and you’re done. Almost all boat insurance specialist agencies write with the same boat insurance carriers, so it is best to develop a relationship with a reputable broker and let them guide you through the boat insurance process.

Next thing you know, you’re out on the water and you can relax.

The following review began as a shared resource for my boating friends at our local marina. We all moored on the same dock (G-Dock at Marina Village) and we often found ourselves complaining about our boat insurance cost and policy details.

Full disclosure: I figured there was a need for a publicly accessible, comprehensive review of the popular powerboat and sailboat insurance providers. It is important to always read your boat insurance policy and ask your boat insurance agent any questions. This article should be viewed as a broad overview of boat insurance. Each insurance policy differs, so ALWAYS reference your insurance policy for coverage details.

After reading this article you’ll have a better idea which is the best insurance policy for you. You should also know how much boat insurance is going to cost you. Almost all the insurance reviews below contain links to receive a free online quote.

In my experience, the best way to get the best boat insurance quotes is to contact one reputable, and specialist boat insurance agent and let them guide you through the process.

This review is divided into 2 parts:

- Boat insurance 101: a summary of the basics of boat insurance (skip this if you’re an old salt.)

- Boat insurance reviews: we discuss many of the best providers. Click here to jump straight to this section.

I combine a range of inputs to create my list of the best marine insurance providers: national ratings, customer feedback, first-hand experience, industry comparisons, boat forum discussions, social media comments, boat insurance average cost and company policy information.

I also warn readers about common problems boaters run into with insurance providers (depreciation levels on older boats, hurricane policies, etc.)

I update this boat insurance comparison page at the beginning of each year. If you have any relevant feedback on your provider, please reach out on our contact page. I’ll incorporate your comments into the next update.

Don’t hesitate to reach out and let me know if I need to correct a mistake. Thanks!

2022 update: I just wanted to say THANKS! to all my readers. I’ve been receiving so many thoughtful emails lately from folks expressing gratitude for this insurance page. That is wonderful to hear and it keeps me motivated to continue updating the page every year.

Share this resource with friends ↓

The basics of boat insurance

Boat insurance financially protects boaters from unexpected mishaps. It’s similar to auto insurance, except there’s no roads, just water.

Coverage

What is covered in your policy? You probably want your boat insurance to cover damage to your boat (hull insurance) and any damage your boat may inflict on other properties (third party liability).

Hull insurance includes repairs or, in the case of total loss of vessel, cash compensation for the agreed value of the boat.

Third party liability covers any mayhem your boat may cause to others objects. Perhaps the wind shifts just as your engine dies… and your boat slams into the marina restaurant, a public pier or another boat. You want your policy to protect you from these possibly huge expenses. If you have a serious mishap at sea, you may incur additional costs for spilled fuel, medical expense, emergency towing, salvage/rescue operations. All of these items are pricey, so you want to be very clear with the specifics of your policy.

Even good boats end up high and dry.

This is me having a bad day up in Alaska.

It happens…Stay insured!

Tip #1: Many marinas require boats to have third party liability policies of $1,000,000 (smaller marinas may only ask for $300,000).

Tip #2: If you are the owner of an older boat, your insurance company may reimburse you for a claim at a ‘depreciated level’. This is often a point of contention with boaters and their insurance provider. If, for example, you damage your boat and incur $1,000.00 worth of hull damage and your provider is paying you out at a 70% depreciation level, this means that, after you pay your deductible, you will only receive $300.00. Make sure you have the ‘depreciation‘ conversation with your insurance agent – and then get all the specifics in writing!

Premium

This is how much your boat insurance will cost you annually.

As you might expect, the broader the coverage, the higher the cost of the premium. Similar to car insurance, more expensive boats will demand a higher premium. It is worth speaking to the agent about the specifics of your boating habits. You may find you’re entitled to discounts. For example, I get a discount because I have a boating license in my state. My friend receives a discount because he stores his boat in a covered shed. If you’re aiming for cheap boat insurance, make sure you get all the premium discounts possible.

Tip #3: Create a boating resume. Take time to create a professional boating resume because your insurance agent can use this to help you get the lowest possible premium for your boat. Write down all of your boating experience because this matters to insurance carriers.

How much is boat insurance???

Here’s some basic math to calculate your boat insurance cost.

Before you start talking to insurance agents, it’s helpful to know the ballpark estimate for your annual boat insurance premium.

Here’s how you get that estimate.

Boat insurance calculator

Determine the current market value of your vessel. 1.5% of that number will be a good approximation for your annual premium.

For example, I own a 30 foot sailboat that is worth $13,000.

So, 13,000 x .015 = 195.00

Therefore, for a typical policy insuring my sailboat, I would expect to pay $195 per year.

In my case, that boat insurance calculation works out about right. I’ve moved around a lot and changed boat insurance companies over the years. On average, I’ve paid about $250 annually for my premium. This has included full hull coverage for my boat, 1 million in third party liability and the regular add-ons (fuel spill, limited towing package, $10,000 in medical expenses for captain and crew).

Expect to pay a higher premium if you live in a state with a high incidence of hurricanes (South Carolina, Florida, etc.)

Tip #4: If you do live in a hurricane prone area, your insurance company may expect or demand that you haul out your boat if a confirmed, dangerous hurricane is scheduled to make landfall near your marina. This can be a major inconvenience as hauling out a boat takes time and money. Make sure to know what is required regarding approaching storms.

Remember…don’t just search for cheap boat insurance. Make sure the policy details are also sufficient for your needs.

Boat insurance…because sometimes things don’t work out.

Boat insurance reviews: my list of the best boat insurance providers

If you have a boat that is longer than 28 feet, you will usually have to use a specialist boat insurance agency who will “shop” with all carriers. Most boat insurance companies will only write policies through an insurance broker (Agent).

A carrier will usually only offer their own insurance product. In contrast, an established broker will have access to multiple carriers, so they can shop around and help you find the best policy. We recommend establishing a relationship with a good broker who offers responsive client service, and can help you navigate the insurance process.

We’ve created a list of the most popular boat insurance companies, but have also included Hanham Insurance Agency, which is a brokerage, because we have heard that Hanham writes with most of the below carriers.

IMPORTANT: The below is an overview of each company, but if you do get a policy or quote, then be sure to read your quote of policy carefully, because coverage can be different for each person or boat.

Hanham Insurance Agency – Hugo Hanham Gross

Hanham Insurance Agency is a popular, independent insurance agency based in Charleston, South Carolina. This agency specializes in US and international yacht owners and writes with the carriers listed in the below insurance review as well as others not listed. Hanham accommodates a range of boat sizes but specializes policies for in boats in the 35 – 90 ft range.

The owner and broker in charge, Hugo, began working for Lloyd’s of London, tailoring policies for superyachts, some of which were worth over $200M+. Hugo says he now prefers to work with owners of smaller yachts because he enjoys the client relationships more on smaller yachts.

From my personal observations and feedback I have heard from Hanham clients, this small sized insurance brokerage is an excellent choice for people who value professional and attentive client service as well as an insurance policy or multiple quotes that are tailored specifically for your needs.

In general, the benefit to a smaller customer-service driven agency – is the attention that your policy receives. I’ve learned that Hugo and his team are devoted to their clients, are always quick to respond, and are actually willing to take time to help and explain things to people.

Update 09/2019: We recently heard of an owner of a 57 motor boat (57ft) who was caught in the current and hit a coral head in the Bahamas. Hanham held their hand their hand through the claims process and the owner told us that “Hugo at Hanham is my broker for life”

Update 04/2020: We recently heard from a Lagoon sailboat (Sailing catamaran) owner that they were able to save over $5K by switching to Hanham. They said that their other broker was charging them for navigation that they didn’t need and that Hugo was able to spot this quickly.

While Hanham is selective about who they will insure, I have heard that they are always helpful, and willing to point boaters in the right direction, even if they cant insure their boat.

Start a conversation with Hanham Insurance Agency. Here’s a link to their quote page.

.

I saw this ship run aground in Thailand. If you’re cruising internationally, make sure your destinations are covered in your policy.

Travelers Yacht Insurance and Travelers Boat Insurance Program

Travelers is a yacht and boat insurance company that offers competitive insurance coverage for boats and yachts that will be cruising the US East Coast and Bahamas. This company can insure sailboats, sailing catamarans, powerboats, and even larger yachts.

While we have heard that travelers is competitive on premium and has one of the best claims service available, Travelers is very selective about the which boats they will insure and as a rule of thumb, Travelers usually requires at least 4 years of similar boat ownership experience before they will quote for insurance. Putting together a good boating resume will come in handy in this case.

For boats and yachts that are newer than 15 years old, Travelers can also include mechanical breakdown insurance coverage by request. It is important to ready your boat insurance policy for coverage specifics, but Mechanical Breakdown Coverage basically covers internal failure of mechanical components not related to an incident. This is a coverage that most boat insurance carriers will exclude in their policies. We recently heard from someone who owns a 60 ft sportfish yacht. This person said the diesel engine had an internal issue and that Travelers sent a diesel mechanic to check it out. Although the engine was not actually broken, the mechanic was helpful and didn’t charge the boat owner anything because Travelers paid for the inspection.

This company also sometimes includes a hurricane haul out reimbursement in their policy, which means that if a hurricane warning is issued, you can haul your boat and the carrier will pay for part of the costs. A win-win for boat parties.

Travelers yacht insurance program will usually not cover a yacht to be in the Caribbean and will not allow a yacht to be south St. Mary’s, Georgia from 1 June – 1 July. This often leads to frustration among boaters, so if you do intend on sailing or cruising south of GA during hurricane season, this company may not be the best company for you.

Update: 06/2020: We heard from a mono hull sailboat owner recently that a boatyard damaged her 45 ft sailboat while hauling and the boatyard would not pay for the damage, which included damage to the hull, rigging, and bulkheads. Traveler’s stepped in and paid for the damage and she was VERY happy.

We have also heard good things from others boaters about their claims service.

If you contact a yacht insurance agency, they will be able to review your information and will quote you with this carrier if you are a good fit.

Concept Special Risks , Accelerant Insurance Company

Concept Special Risks is one of the largest yacht insurance carriers and specializes in boats that are located in areas that have named storm (Hurricanes and Tropical Storm) exposure and also boat owners who want to cruise not on the US and Bahamas, but also cruise the Caribbean and even worldwide

Concept Special Risks also has a reputation as a carrier that can insure first time boat owners or boat owners with limited boating experience. If you are a first-time boat owner or have limited experience, then be sure to make a boating resume to send to your yacht insurance broker so that she/he can get you approved. A good boating resume will help you.

This yacht insurance carrier is also one of the most flexible insurance carriers when it comes to navigational changes. This carrier can even insure boats that are in the Virgin Islands during hurricane season, so long as you have a strong hurricane plan that the insurance carrier reviews and approves.

We have heard that Concept offers a fast turnaround time. A motor boat owner told us that they needed to get their new hurricane plan approved on a Friday before a hurricane hit that Saturday and that Concept was able to approve within hours. Most companies cannot offer this quick service.

Concept Special Risks also has a reputation for being able to insure older boats and boats that are custom builds as well as boats that do not fit the traditional model of build or cruising area.

Update 05/2020: We heard from a catamaran sailboat owner who hit a bridge and badly damaged their rigging and mast. They said this carrier paid their claim which apparently was “not cheap”.

We have also heard that Concept can insure charter boats and can offer 3rd party liability coverage of up to $10,000,000 for some boats that charter.

If you contact a boat insurance agency, they will be able to review your needs and will quote you with this carrier.

Safe Waters Underwriters

Safewaters Yacht Insurance Underwriters is one of the most competitive carriers available and insures boats from $100,000 in value all the way to $20,000,000, but are VERY selective about which vessels and specifically, which vessel owner’s they will insure.

This carrier has a reputation for being very competitive on premium but requires at least 2 years of boat ownership experience on a similar boat. Safewaters will not insure any boat owner who has had a boat insurance claim either. This carrier will only insure a yacht that is in Florida during hurricane season if Florida is the boat owner’s only and full time residence and has an approved hurricane plan.

If you are a first time boat owner, have had a boat insurance claim, or are a liveboard, then Safewaters is not the carrier for you. If you contact a yacht insurance agency, they will be able to review your information and will quote you with this carrier if you are a good fit.

Update 01/2020: We heard from a Leopard Catamaran owner who’s boat broke free in a hurricane and had the hull damaged badly. They said that Safe Waters handled the claim really well and that the company was easy to work with and paid for the damage. This person also said that although there was a separate hurricane deductible, they thought the insurance company treated the claim well.

We also heard from an Azimut 65 power boat owner, that this company paid for half of their haul out during a hurricane to protect the boat.

If you contact a yacht insurance agency, they will be able to review your information and will quote you with this carrier if you are a good fit.

American Modern Insurance Company

American Modern Insurance Company, until recently, specialized in boat insurance for boats 27ft and under in size, but recently has become competitive for boats that are over 27 ft and up to $1M in hull value.

While this company is relatively new to the yacht insurance market, we have heard that they are competitive on premium and also are able to insure boats and yachts that are in Florida during hurricane season, so long as they approve a hurricane plan. We have heard that this company can offer a permissive use boating policy which allows anyone to drive the boat without having to have the insurance company approve the operator. Be sure to check your policy though.

American Modern Insurance Company is more suited to boaters who cruise US waters, but want to make a short trips to the Bahamas. This boat insurance company will not cover boats that are primarily based in the Bahamas or in the Caribbean.

We have also heard that American Modern can insure performance boats that go faster than 100 mph….which is hard to imagine, but these boats do exist!

If you contact a yacht insurance agency, they will be able to review your information and will quote you with this carrier if you are a good fit.

Geico Boat Insurance (BOATUS).

Geico boat insurance owns BoatUS insurance and we have heard that this carrier can be competitive on premiums for boats based north of Florida during hurricane season, but have become expensive on premiums for boats that are based in Florida. We have also heard that this carrier requires a good amount of boating experience before they will insure a boat.

This company allows you to get a quote online, but a lot of boat owner’s prefer to be able to work with a broker who can help them through insurance process and tailor a policy to fit their specific cruising needs. We have also heard that this company can offer a diminishing deductible each year.

This boat insurance company is a good fit for boaters who want a cheap premium and do not mind calling a 1-800 number to speak to a representative. Also be sure to read reviews online from this company before you bind a policy.

Yachtinsure Underwriters, Clear Blue Insurance Company

Yachtinsure at one time was one of the best carriers for boaters based in the USA, as well as boat owners that cruise worldwide. This carrier offers good client service and we have heard great things about their claims department being very responsive and easy to work with.

This company is able to all types of boats that are based in Florida, Bahamas, And the Caribbean during hurricane season, as long as you are able to submit a boat hurricane plan that they feel is safe and that they approve. We have heard from cruisers that kept their boat in the US for the first year then wanted to sail to Panama and through the panama canal and Yachtinsure was able to easily adjust their policy do to this.

Update 12/2019: We heard from a SeaRay 55 boat owner that had his boat destroyed in a hurricane that this company sent an insurance adjuster and a salvage diver to find his boat. Once the boat was found underwater, the carrier verified that is was a total loss (Write Off) and paid him quickly for his boat. This person also said that the claims manager helped him over the weekend.

If you are working with a yacht insurance broker, then ask them if Yachtinsure might be a good fit for you and your cruising needs.

Topsail Insurance

Topsail Insurance is a British boat insurance company that was launched in 1996 and now provides specialist yacht and motorboat insurance to a worldwide community. Topsail is based out of the Brighton Marina in East Sussex, England.

This group specializes in long distance and blue water cruising insurance. Their focus is boats that are cruising in the UK, Northern Europe, the Mediterranean, the Caribbean, Pacific Regions, South East Asia and Polynesia.

We have heard good things about this boat insurance company and have heard that they can insure sailboats all over the world, but have heard that they sometimes exclude named storm damage in their policy, so it’s important to read your boat insurance quote carefully.

Pantaenius Yacht Insurance

Pantaenius Yacht Insurance Company has pulled out of the yacht insurance marketplace and no longer insures boats. This company does have a European branch that insures boats in Europe as well as European boat owners, but we have heard from many boaters that if you are a US boat owner or US resident, this insurance company will not insure the boat

Pantaenius has been in the insurance business since 1899. The yachting section of their company has been in operation since 1977. Pantaenius is very much an international entity with offices in Germany, Monaco, Spain, Denmark, Australia, Austria, United Kingdom and America.

Pantaenius offered a very popular policy called the ‘America Yacht Policy’.

Progressive

Most people are familiar with Progressive, or at least with Flo, their TV spokeswomen. . They began in 1937 with a drive-in claims office, they are now ‘progressive’ in that they allow online shoppers the chance to see comparison rates.

Progressive is not really set up for yacht insurance.

Google’ “Progressive Boat Insurance Reviews” and see for yourself………not the best reviews in my opinion.

Progressive insures a wide range of boat types, however, there are quite a few boating scenarios that aren’t covered by Progressive. Most strikingly, Progressive will not insure a boat over 50 feet in length and/or with values over $250,000.

Progressive also won’t offer physical damage coverage on a boat that is both more than 15 years old and worth more than $20,000 (it should be noted that many boats fall into this category). They also won’t insure boats used as a primary residence (live-a-boards). And, if you have a houseboat with no engine or a boat with more than 2 owners, Progressive will not offer you a policy.

At the time of writing, Progressive doesn’t require a recent boat survey and they cover up to 75 miles offshore (that includes Catalina Island…for all of our California readers).

On May 2017, I heard from a reader who reported an unexpected doubling in price of his Progressive policy. This reader owns a 21′ fishing boat. Upon inquiry, Progressive informed the reader that all rates had gone up in his state. They also said his credit score had dropped, however the reader claims his credit score has improved. I’m not sure about this one…but if you are with Progressive, you may want to confirm your policy’s price.

Chubb Insurance Company

Chubb, formerly Ace is one of the oldest marine insurance companies around.

Chubb’s Masterpiece Boat and Masterpiece Boat Select policies are designed for all types of pleasure boats 35 feet and less, as well as Personal Watercraft (PWCs) vessels like waverunners and jet skis. This company offers fast client service and we have had that they have a good claims department. This carrier is selective about which boat owners and boats they will insure.

This carrier has a good reputation among boat owners, but has become expensive on premium for boats that are south of the Chesapeake bay during hurricane season. If you keep your boat south of the Chesapeake bay during hurricane season, this carrier may not be the best for you.

Allstate

Allstate is a massive insurance company that insures most types of assets, including boats. They were founded in 1931 by the Chairman of Sears Roebuck.

Allstate has a good reputation for providing affordable insurance for small boats. (under 20ft) As of 2015, they claimed their average monthly premium cost for boaters is $20.00. That puts their average annual premium cost at $240.00. $240.00 is a very low price for boat insurance, however, you need to be careful with these ultra cheap policy premiums. Make sure the coverage is broad enough to include all the possible mishaps you may find yourself in. Also, keep in mind, this $240 number from Allstate will go up quickly if you own a larger boat or live in a hurricane prone location.

Part of the reason for Allstate’s lower rates is their discounts. You receive a 20% discount by combining an Allstate homeowner policy with boat insurance. If you pay the full premium upon signing up, you can knock off another 10%. And if you’ve taken an approved boat safety course, take another 5% off your premium. These discounts can add up…

Other boat insurance companies for small boats (Under 27ft)

State Farm Insurance

USAA Boat Insurance

Nationwide Boat Insurance

Foremost Insurance Company

SkiSafe

Alright…that’s the end of our review.

We hope our 2022 boat insurance comparison provided a few ideas and helped you start the process of getting your boat insured. When you’re ready, pick up the phone and get quotes from at least 3 providers. That should give you a feel for the range of price and coverage for you and your boat.

Boat safe!

Do you need some comic relief ??

Does your brain hurt from reading these boat insurance reviews and thinking about boat insurance cost?

Our good friend Captain Ray just typed up his all-time, tried and true, best-ever nautical joke. This would be the classic Red Shirt Captain joke…

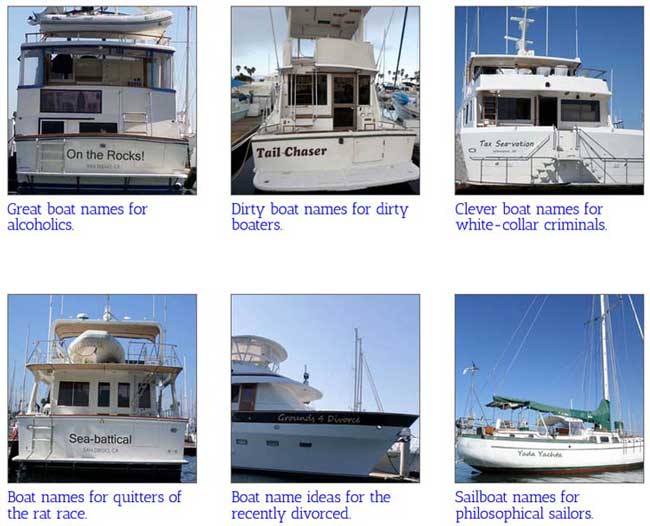

Well, if that’s not enough for you, we have also built a boat name page that is pretty awesome.

Here at All Things Boat, we are all too familiar with the stereotypical boating personalities you find out on the water. So…we decided to make a boat name page organized by all these classic boater types.

Enjoy!

If you have any questions or comments, don’t hesitate to reach out.

You can message us here.

All Things Boat presents…

“The coolest stuff to have on board in 2020”

Each nautical gift item handpicked by Captain Ray Roberts.

Disclaimer: We do our best to ensure the information on allthingsboat.com is accurate and updated at all times, however, we are unable to guarantee the accuracy of all information. Efforts have been made to keep the content up to date and factual. However, the boat insurance average cost for a policy and the policy details will change year to year. A provider may provide cheap boat insurance one year, but then transition to high-end boating clients the next year. For the most current and complete policy details for both powerboat, yacht insurance and sailboat insurance, please verify with the provider directly on their website or through an agent. Our links to the various online boat insurance quotes will provide you with the most recent pricing information for different boat insurance company policies.